Generation Z is in constant fear of the future. Why you may ask? Simple, the cost of living has skyrocketed and wages don’t accommodate for a comfortable life anymore. For example, in the ’90s housing was much more affordable with lower median house prices. In the 1990s the median house value was $79,100 whereas the current house value is around $426,056. For reference, the average salary for an American household in 2024 is around $74,000. In the 90’s the average salary was $30,000. So that represents that the average American is getting paid twice as much but housing has increased by 5 times. Was it easier for young people in the 80s/’90s to live a comfortable life? Mr. Walker a computer graphics teacher from Bonner Springs High School explained, “I have two daughters and they are struggling to be able to afford their own new house because prices are high and that wasn’t the case when my wife and I got married”.

Housing Market

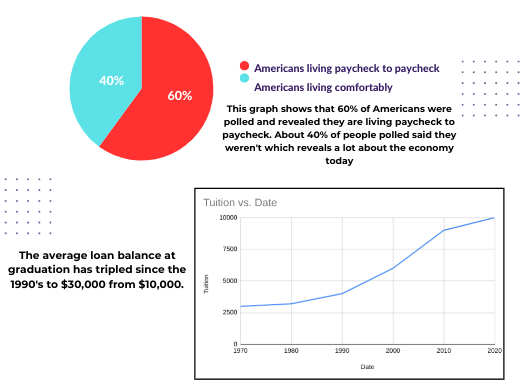

In the 1980s/90s a young adult could find a job with benefits that paid them enough for them to buy a home. Fast forward 30 or 40 years and the gap has increased astronomically. Why is that? Well, that’s partly because of “Zoning laws”, that regulate the location of homes and the density of a neighborhood so to speak. Other factors contribute to increased house prices like fewer people selling their homes and fewer houses on the market meaning retailers can charge more. In addition, 60% of Americans are living paycheck to paycheck and most people don’t have emergency spending to fall back on. Prices of food and goods have also increased and the average CPI (Consumer Price Index) quadrupled from 38.8 to 172.2. As of 2022, the national CPI had increased to 500% since the 70’s, and wages have only increased by 80%. This leaves future generations helpless because the average American wages can’t keep up with the continuously rising prices for gas, food, and bills. According to Bank of America, consumer spending is at the lowest it’s been since before the pandemic because people can’t afford to pay for personal items anymore.

Purchasing Power of Gen Z

However the biggest concern currently is wage growth, it’s heavily decelerating as layoffs increase and the economy falls into recession. So what does this mean for Generation Z who are just dipping their toes into the housing market, college, and job opportunities? Well according to Financing the Future, “Gen Z has 86% less purchasing power than baby boomers did in their 20’s. Not to mention we haven’t even started to talk about student loan debt and the price of tuition to apply for college. Student debt is now a 1.7 trillion dollar crisis and between the years of 1991 and 2021 college tuition has doubled. According to The College Board, Trends in College 2019 Report “Around 7% of student loan borrowers are now more than $100,00 in debt”. Across all types of schools including Ivy League, the cost of college has increased by more than 135% between 1963 and 2021.

College & Tuition

Is it still worth attending college when most students owe thousands in student loans? Mr. Walker said, “I’m a big believer that I think colleges have hurt our country. They’ve turned colleges from an educational institution to almost like a resort not caring how it’s going to affect them negatively”. Unfortunately, the rising cost of college has discouraged many students from attending college. Most students are low or middle class meaning their only option is to take out a student loan or hopefully get a full scholarship. So let’s create a summary so far, Generation Z is struggling with more student debt, lower wages, higher cost of living, and expensive housing. So does the government have a solution? Well, Kind of. The Federal Reserve needs to fight inflation by enacting the smart fiscal policy which can help assist the Fed in reducing inflation without straining employment and financial stability. Do you think the government is trying to take action so Americans can meet basic needs? According to Mr. Walker, “I think there’s going to have to be some regulation and laws passed on how people can go about business”.